Table of Contents

Teaching children the value of saving money is an important quality that helps them make smart financial decisions as they grow. Developing a saving habit from an early age not only learns children about money management, but also helps them understand the importance of money and responsibility throught their life. By learning to save, children may feel proud of their performance and become more thoughtful about their expenses.

Many parents wonder how their children are guided in the production of this habit, without any work. The good news is that it can be fun to teach children about savings and rewarded when done with simple steps and clear examples. Whether it is saving coins in spare pigs or putting different money for a special toy, small lessons can quickly create a strong base for their financial future.

Why Teaching Kids to Save is Important

1: What is a stock?

Teaching children to save money is a valuable thing. This helps them build smart habits from an early age, making them more responsible with their money as soon as they grow up.

1. Helps children understand the value of the money

When children save, they learn that money is earned and not just given. They begin to see that every coin or patch is valued. For example, saving small amounts each week can help them buy something special later. This helps children feel that the money is not endless and should be used with care.

2. Teaches Planning and Goal Setting

Savings help children set goals. Maybe they want a new toy, a bike or a gift for a friend. By saving the least money, they learn how to plan for these things. This shows them that it is time and effort to reach a goal, but it feels good when they finally get what they want.

3. Do good habits for the future

Children who learn to save quickly are more likely to handle money as adults. They know the importance of keeping some money for future needs such as school, travel or emergency. These good habits help them avoid stress about money later in life.

4. Encourages Responsibility

When children manage their savings, even a small amount, they feel more responsible. This teaches them to think before using and making careful alternatives. This feeling of responsibility helps them in many other areas of life, such as school work and personal decisions.

5. Makes Saving Fun and Rewarding

One should not be boring to save. Using fun devices such as spare pigs, saving jars or reward maps can make the experience exciting for children. When they see their savings grow, they get a sense of pride, and they are happy with their progress.

SEBI-Compliant Stock Market Training

Trusted, practical strategies to help you grow with confidence. Enroll now and start investing the right way.

Know moreWhen to Start Teaching Saving Habits

Teaching children to save money is an important part of their learning. Many parents are wondering what age to start this lesson. The simple answer is: as soon as possible. Children are never in a hurry to learn the value of savings, although it starts with just a few coins in a small jar.

1. Ages 3–5: First Steps with Money

For very young children, at the age of about 3 to 5 years, savings can be introduced in a fun and easy way. At this age, children like to use coins in a piggy or a jar. They can’t quite understand how money works, but they can see savings help them collect more coins over time. This is a great first step because it helps them use them for the idea that money can be saved and not used immediately.

2. Ages 6–10: Learning with Pocket Money

When children reach school age, at the age of around 6 to 10 years, they can begin to learn more about savings with clear examples. For example, if they receive pocket money or gifts in cash, parents can guide them to divide their money into two parts – one to spend now and to save one later. This helps children learn to create an alternative with their money. It also teaches them patience and how they can plan ahead for a toy, book or game, what they want.

3. Ages 10–12: Setting Bigger Savings Goals

When the children are around 10 to 12 years old, they can understand the habits of more detailed savings. They can learn about determining large savings goals, such as bicycle savings, a school trips or a special gift for a family member. At this stage, it is useful to talk to them how the savings work in real life – for example, saving for emergencies or future needs. Parents can also show children how banks or savings accounts work, which makes the lesson feel bigger and genuine.

4. Why Starting Early Matters

Early start helps children develop smart money habits that will help them grow in teens and adults. This teaches them important life skills such as patience, plan and responsibility. When savings become a habit from a young age, children are more likely to manage their money carefully in the future. They want to know that it is not always about using everything at once, but also about keeping something different later.

Practical ways to Instill Saving Habits

To teach children to save money, they should not be difficult or misleading. In fact, with some simple steps and a little patience, parents can help their children build strong savings habits that will last a lifetime. To save the key is natural, fun and part of their everyday routine. There are some simple and practical ways to guide children to learn ways to save money:

1. Introduce a Piggy Bank or Saving Jar

A piggy bank is a great first step for young children. This gives them a special place to keep their money and grow them. For very young children, saving some coins can feel exciting. You can also use a clear jar so children can see how much they have saved. Seeing the glass Phil up prevents more real and rewarding for them.

2. Set Simple Saving Goals

Children need to know why they save. Help them set up small and clear goals, such as saving for a new toy, a book or a family outing. When children have a goal in the mind, they feel more inspired to save. You can write the goal on paper and keep it as a reminder with your savings piggy bank.

3. Teach by Giving Pocket Money

Giving children a small allowance or pocket money is a useful way to learn savings habits. Instead of using all this at once, encourage them to distribute the money into parts: a lot to use, part of saving and maybe some to share or donate. This simple practice helps them learn how to handle money in a balanced way.

4. Use a Reward System

It should be a positive feeling for children to save money. You can install a reward system to make it more fun. For example, if they reach a savings goal, they can earn a little extra reward as a special treatment, a sticker or extra flat. Prices can help children feel proud of their efforts and to be motivated to save.

5. Lead by Example

Children learn a lot by looking at their parents. If they see you to save money, they will understand that this is a common and important habit. With simple words, it talks openly about your own savings goals, such as saving for a vacation or buying something for the home. Shows them how you save, the lesson seems more real and meaningful

6. Open a Savings Account

For older children, opening a savings account can be a good step in a bank. This makes savings feel more serious and bigger. While opening your account, take your child with you and explain how it works. Let them follow them on the balance so they can see how their money increases over time.

7. Talk About Needs vs. Wants

Learning the difference between needs and obligations for children is an important part of savings. Help them to understand that things like food, clothing and school supply are needed, while toys, sports and behavior. This simple lesson helps children use and make smart savings options.

8. Be Patient and Consistent

It takes time to build a saving habit. Children cannot always save completely, and this is good. What is most important that he is a patient and matches your teaching. Remind them and encourage them, and celebrate their progress, no matter how small.

Use Real-life Scenarios (Snacks vs Saving for Toy)

One of the simplest ways to teach children about savings is to use real life conditions that they can see and feel in everyday life. A simple example is to help them choose to save the same money to buy snacks or later toys. This little everyday choice teaches children an important lesson about money, patience and smart decisions.

Imagine your child has ₹50. They visit a store and see chips, chocolates, or other snacks they like. These snacks value exactly ₹50. At the same time, your infant additionally desires a toy, a puzzle, or a doll that costs ₹200. Now comes the learning moment: your baby has to determine whether or not to shop for the snack now or shop the money to shop for the toy later.

You can explain them in simple words: “If you buy a snack now, you will enjoy it today, but the money will disappear. If you save this at 50rs and add more money later, you can buy the toy you really want.” By showing this option clearly, your child begins to understand how the savings work works. They see that spending money can quickly give a small, short-term happiness. But waiting and saving leads to a big, more permanent reward.

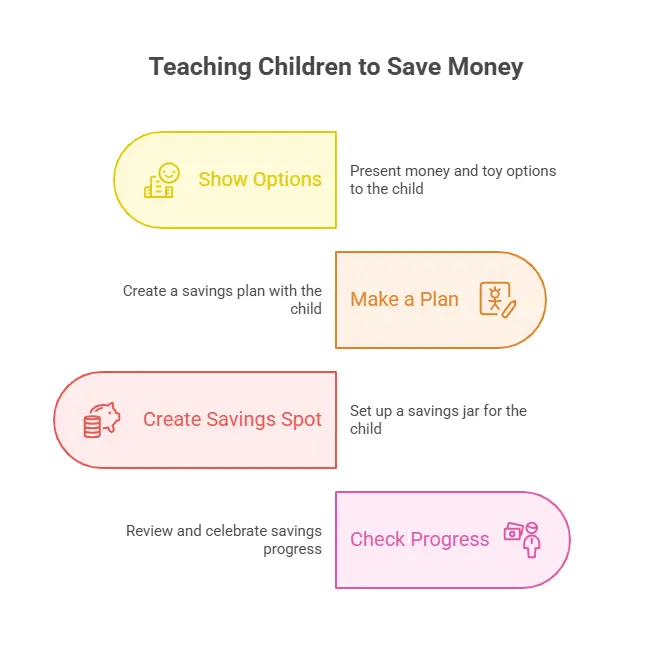

Step-by-Step Explanation:

Here is the step by step explanation of how could use real life scenario for saving habit in children,

Step 1: Show Both Options Clearly

At home, you can show them ₹50 and a snack. Then show them a picture or the real toy they want. Let them see both things at the same time. This helps them think carefully about what they really want.

Step 2: Make a Simple Plan Together

Say to them, “If you save ₹50 today and add ₹50 more next time, you’ll have ₹100. In a few weeks, you will have enough to buy the toy.” Help them count how many times they need to save. This teaches planning in a fun and easy way.

Step 3: Create a Savings Spot

Give your child a jar, box, or piggy bank. Write “Toy Savings” on it. Every time they choose saving over snacks, let them put the money in the jar themselves. Watching the money grow in the jar makes them feel proud and happy.

Step 4: Check Progress Together

Every few days or once a week, sit with your child and count the money in the savings jar. Celebrate each step with kind words like, “You’re getting closer to your toy!” This keeps them excited and motivated to save more.

🔷 Why This Method Works:

-

It’s Easy to Relate To: Children face small money choices like snacks versus toys all the time. This example feels real to them.

- Learning Patience and Plan: It shows children that waiting and savings can provide greater prizes than using quickly.

- Money creates awareness: Children learn that money is limited, and smart alternatives help them achieve what they really want.

- Both fun and learning include: using a savings pot, counting money and setting goals feel like a fun game instead of a boring rule.

Lead by Example: Saving Habit in Children

Children learn the best of looking at people around them. If parents show the habits of good savings in everyday life, children are more likely to copy the habits. For example, leading children are a powerful and easy way to learn to save money.

1. Show Your Own Saving Habits

See your child to save money. For example, if you put money in a jar or a bank account, you can share that moment with them. As such things say, “I save for my family trip” or “I save to buy a new fridge.” This helps children to understand that savings are important for both children and adults.

2. Talk About Smart Spending Choices

While you shop, tell the decision about your expenses out loud. If you do not decide to buy something because you save, you can tell your child: “I want it, but I will save my money instead.” This shows them that it is okay to wait and plan instead of buying things immediately.

3. Involve Kids in Family Saving Goals

To save a family activity. For example, if you save for a home or save a large object, leave your child part of the process. Show them how much you have saved so far and how much is needed. It teaches them patience and teamwork.

4. Avoid Impulse Buying in Front of Children

If children often see parents buying things on impulses, they may think that it is normal to use quickly. To show careful shopping stoves-for example, comparing prices or waiting for sales – you teach children that it is a good habit to make smart money.

5. Share Your Own Savings Goals

Tell your kids about the things you save, such as a new phone, car or emergency fund. When they hear stories of your real savings, they understand that savings are not just a rule-it’s part of life for everyone.

Learn Stock Marketing with a Share Trading Expert! Explore Here!

SEBI-Compliant Stock Market Training

Trusted, practical strategies to help you grow with confidence. Enroll now and start investing the right way.

Know moreTeach the Value of Delayed Gratification

Delayed gratification means waiting for it to enjoy something instead of immediately. It is important to teach children this skill because it helps them to be patient and serve smart alternatives with the money and other things in life. It is not always easy for children to wait, but learning this habit helps them in a long time.

🔷 Why Delayed Gratification Matters

Children often want things immediately to be a toy, a snack or any thing else. But if they always get what they want immediately, it can be difficult to manage money, or it can be difficult to handle big decisions because they grow up. Waiting for a great reward, learning to be more patient, responsible and careful, helps children how they spend money.

For example, imagine that a child has 50rs. They can now use it on a small candy or save it until they have 200rs, they like to buy a toy. If they choose to Save, they are practicing delayed gratification. Waiting to teach them that some things are worth waiting.

🔷 Simple Ways to Teach Delayed Gratification

🔶 Set Saving Goals: Help your child set a clear goal. It can save money for a toy, a new book or even a gift for a friend. Write a measure of a paper or make a small chart. Every time they put money to their savings, they show them how close they are to reach their goals.

🔶 Use Real-life Examples: Use simple examples from daily life. For example: “We don’t buy ice cream today because we save for the family’s picnic next week.” This shows them that waiting can be something more special.

🔶 Give Choices: When you give pocket money, explain that they can either use all this now or save something later. Allow them to make options, but remind them of waiting benefits. Over time, they will learn to make smart decisions.

🔶 Celebrate Their Patience: When your child succeeds in waiting and saving for something, he convinces. Praise his efforts by saying such things: “You waited so well, and now you found the toy you wanted. Great job!” This makes them feel proud and motivates them to practice satisfaction.

How this Helps in the Future

Learning to wait does not only help to save money. It also helps children in other parts of life, such as studying, working hard for a goal or planning for the future. Those who know how they wait usually make a better alternative to school, work and personal life.

Digital Tools & Apps for Teens

In today’s world, many teenagers use smartphones and tablets every day. Along with chatting and playing games, these devices can also help them know how to save money and manage them carefully. There are many easily used apps that help you create good savings habits for youth. This digital equipment learns about the fun, simple and useful of money.

1. Pocket Money Management Apps

Some apps help young adults manipulate their pocket money through displaying how lots they have, how a lot they’ve spent, and how much they’ve stored. Apps like this paintings like a digital pocket book in which they are able to write down whenever they get or spend cash. This facilitates teens keep music in their spending and saving without difficulty.

2. Goal-Based Saving Apps

There are apps that allow teenagers to set saving dreams. For instance, if they want to store for a new phone or headphones, the app helps them set a target quantity and indicates how a lot extra they want to keep. Watching their financial savings develop on the display could make them feel proud and inspire them to keep more.

3. Virtual Piggy Banks

Some apps act like a virtual piggy bank. Teens can create distinctive “jars” for exclusive functions like saving, spending, or giving. It teaches them how to divide their money well in place of the use of it unexpectedly.

4. Learning and Quiz Apps

Many apps also train young adults approximately money through amusing video games and quizzes. These apps give an explanation for saving, spending, and budgeting in easy language, helping young adults study essential cash abilties at the same time as having a fun.

5. Bank Apps for Teens

Some banks offer special money owed and apps just for teens. These apps display account balances, assist with small savings, and from time to time include spending limits to help young adults discover ways to control actual money in a safe way.

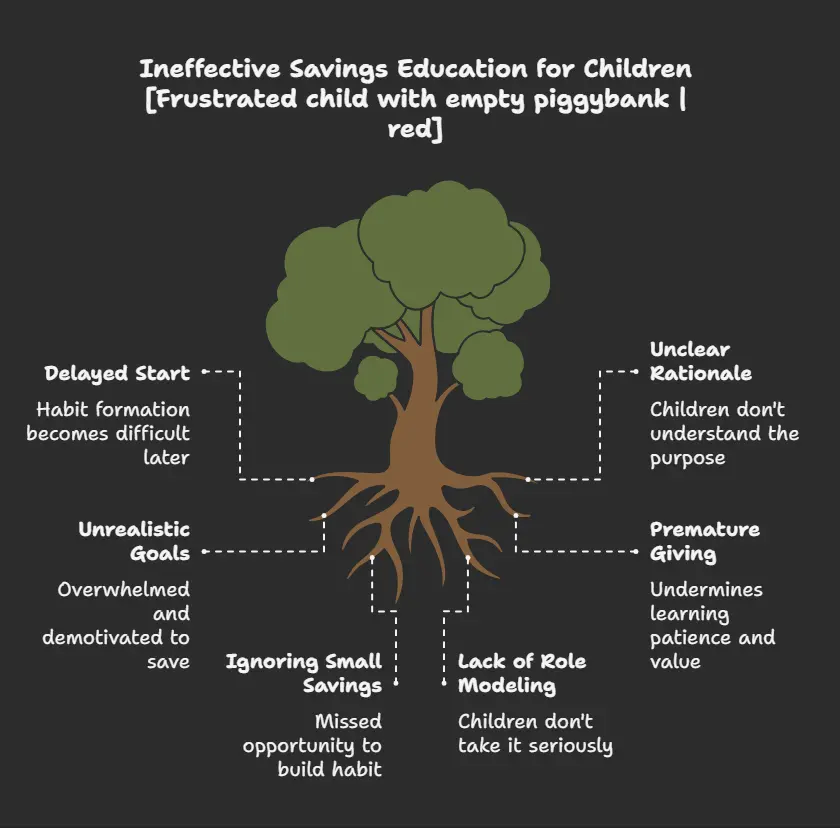

Mistakes to Avoid: Saving Habit in Children

Teaching children to save money is an auxiliary and valuable lesson. However, while guiding them, parents and teachers sometimes make small mistakes that can confuse children or feel difficult to protect them. By understanding these common mistakes, you can help children learn to protect habits in a simple, fun and effective way.

1. Starting Too Late

Many parents wait for their children to grow up to talk about money and savings. But the truth is that the savings habits should start quickly. Even young children, at the age of 3 to 5, can learn simple lessons such as using coins in a pig pig. Late start can make it difficult for children to develop habit naturally.

2. Not Explaining Why Saving is Important

If you tell a child, “you should save” without telling them why, they can’t understand the reason. Children require clear and easy explanation. For example, saying, “We save money so we can buy something special later,” help them see the goal behind savings.

3. Setting Big or Unrealistic Goals

If a child saves something that seems very large or expensive, they can feel impossible and give up. Always start with small, simple goals that match the child’s age and pocket money. For example, savings for a small toy, a book or a puzzle are more encouraging than saving an expensive thing.

4. Giving in Too Easily

Sometimes, when children save something, parents can be beyond to buy it instead. While it sounds like a kind of gesture, it removes the learning experience. Let children now save their savings. This helps them feel proud and learn patience.

5. Ignoring Small Savings

Some parents think in small amounts like some coins, it doesn’t matter. But for a child, small savings are a big thing. Even saving ₹5 or ₹10 teach them the habit of keeping money aside and increasing over time.

6. Not Showing Your Own Saving Habits

Children learn best by looking at adults. If parents ask to save children but do not save themselves, children cannot take the text seriously. Show them how to save family needs or personal goals. With simple words, talk openly about your savings.

7. Making Saving Feel Like a Rule or Chore

If savings appear to be a dull rule or something they should do, children cannot enjoy it. Saves fun using a jar, colorful chart or simple apps designed for kids. Celebrate the small achievements to keep them inspired and happy.

Learn Stock Marketing with a Share Trading Expert! Explore Here!

Conclusion

SEBI-Compliant Stock Market Training

Trusted, practical strategies to help you grow with confidence. Enroll now and start investing the right way.

Know moreFrequently Asked Questions

At What Age Should I Start Teaching My Child About Saving?

It is best to start teaching children about saving children at the age of 3 to 5 years. At this age, they can understand simple ideas like using coins in a piggy bank. As they grow up, you can gradually introduce them to more detailed lessons, such as setting a savings goal or using a bank account.

How Can I Make Saving Money Fun for My Child?

You can make fun to save spare pigs, colored jars or charts. Sit small goals, such as savings for a toy or fun excursion, and every time your child adds money to your savings. Using such apps or games that learn money skills can also make learning fun.

How Much Money Should My Child Save?

There is no fixed amount. A good practice is to help your child dividing your money into parts: a part for savings, a lot to use, and maybe a small part to share or donate. For example, if they get ₹100, encourage them to save ₹30–₹50. The key is to build a habit, even with small amounts.

What If My Child Spends All Their Money Right Away?

It is normal for children to make mistakes while learning. If your child spends all their money, slowly explains the importance of savings and gives them another chance to practice. You can decide the clear goals and regularly check how they manage their money.

Is It Better to Give Pocket Money or Only Money for Specific Things?

Regular pocket money is a great way to learn savings habits. This allows children to make their money decisions. You can guide them to share your pocket money into expenses and savings. This helps them learn from both their good choices and small mistakes.

How Can I Teach Older Children and Teens About Saving?

For older children and young people, you can save apps such as digital tools or open bank accounts. Teach them to determine big savings goals, make budget and understand the difference between needs and wishes. Sharing examples of real life, such as saving a telephone or school trips, can also help them join the habit better.